Being Broke? Turn It into Wealth: Start Your Journey Today

The feeling of being broke can be frustrating, depressing, and overwhelming. But what if being broke is just the beginning of your path to real wealth? You are not alone; millions of others have been where you are now. The good news is that with the appropriate strategies, mindset, and dedication, anyone can move from broke to wealthy. I

n this article, we’ll look at 7 tried-and-true strategies for achieving that transition.

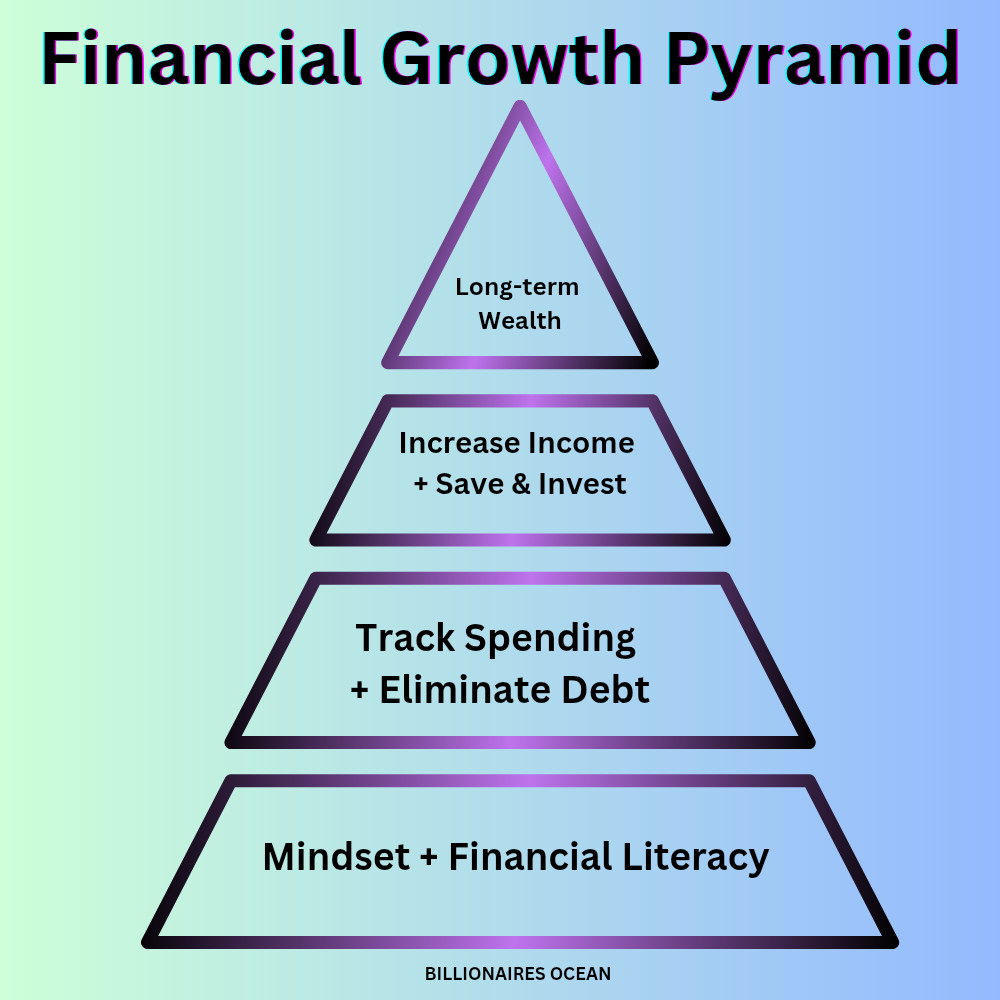

- Change Your Mindset About Money

- Track Every Penny You Spend

- Increase Your Income Streams

- Save and Invest Smartly

- Eliminate Bad Debt

- Learn Financial Literacy

- Stay Consistent and Patient

1. Change Your Mindset About Money

Your financial reality is shaped by the way you think about money. Because they think wealth is “for others, not me,” many individuals continue to live in poverty.

- Daily Affirmations: Say something uplifting to start your day, such as “I can create wealth.”

- Visualization: Picture your life once you have achieved financial prosperity. Motivation is strengthened by this.

- Gain Knowledge from Success Stories: Read about individuals who started out poor and ended up being rich. Allow their experiences to motivate you.

- Stay clear of harmful influences: Spend less time with those who complain about money since they may unintentionally promote the idea of scarcity.

- Financial Journaling Objectives: Clarity and accountability are created when clear financial goals are put in writing.

Read more: Money Mindset Mastery: Think Rich Before You Get Rich

2. Track Every Penny You Spend

When you’re broke, every rupee matters. Tracking expenses might identify hidden financial breaches.

- Divide spending into five categories: rent, food, transportation, entertainment, and optional spending.

- Set Spending Limits: Determine a budget for each category.

- Identify “money drains” by canceling subscriptions or reducing luxury purchases.

- Weekly Review: Evaluate what works, make adjustments, and plan ahead.

- Use budgeting apps: Tools like Mint and YNAB (You Need A Budget) make tracking easier.

Read more: Psychology of Money: 5 Secrets Billionaires Use to Build Wealth

3. Increase Your Income Streams

Many people are kept in poverty by relying solely on one job. Having several sources of income increases wealth growth and diversifies risk.

- Freelance: Make your writing, design, coding, and social media abilities available online. Establish a YouTube channel, blog, or produce digital goods to generate passive income.

- Investments: Over time, modest sums of money invested in stocks, bonds, or mutual funds increase in value.

- Upskilling: Acquire in-demand skills to launch a new career or increase your income in your existing position.

- Time management: Set aside specific hours each week for side projects.

Read more: 10 Side Hustle Ideas [Earn More & Succeed Fast] 2025

4. Save and Invest Smartly

Savings is the first step toward becoming wealthy, but investing is the key to increasing wealth.

- Emergency Fund: Put aside enough money to cover three to six months’ worth of expenses.

- Automatic Savings: Configure savings accounts to receive automatic transfers.

- Start Early, Invest Small: Even small monthly investments of ₹500–1000 in index funds or mutual funds grow in value over time.

- Diversify Your Investments: Spread out your risk rather than depending on just one kind of investment.

- Quarterly Review: Assess growth, stay clear of panic sales, and make necessary adjustments.

Read more: How Abundance Gratitude Boosts Financial Growth [5 Steps]

5. Eliminate Bad Debt

One of the biggest barriers to becoming broke is debt. Payday loans and credit card debt with high interest rates deplete your income.

- Debt Snowball Method: To stay motivated, pay off the smallest obligations first.

- Debt Avalanche Method: To reduce interest costs, pay off high-interest obligations first.

- Bargaining Terms: Request reduced interest rates or installment programs.

- Prevent New Debt: Only borrow money for necessities or investments.

- Monitor Debt Reduction: To stay inspired, recognize and celebrate accomplishments.

Read more: 7 Myths About Money (Smart Truths for 2025 Success)

6. Learn Financial Literacy

The most effective strategy for transforming poverty into riches is knowledge.

- Read financial books such as “The Intelligent Investor,” “Rich Dad Poor Dad,” and others.

- Follow Experts: Money management websites, YouTube channels, and podcasts.

- Gain a basic understanding of investing by learning about stock markets, mutual funds, ETFs, and compounding.

- Apply Knowledge: Act on what you’ve learned. Establish a side business, make a budget, and open an investing account.

- Ongoing Education: Gaining financial literacy takes a lifetime.

Read more: How to Be Financially Independent in 2025 [Ultimate Wealth Shift]

7. Stay Consistent and Patient

It is rare for financial success to occur suddenly. Because they quit too soon, many people still live in poverty.

- Establish reasonable objectives, both long-term (investment targets) and short-term (monthly saves).

- Monitor Progress: To maintain motivation, acknowledge minor victories.

- Modify, Don’t Quit: Persistence is essential; strategies may need to be adjusted.

- Mentality Counts: Prioritize development over quick fixes.

- Persistence Benefits: Money builds up over years rather than days.

Read more: How Abundance Gratitude Boosts Financial Growth [5 Steps]

FAQs related to being broke

What does being broke mean?

Being broke means having little or no money left — struggling to cover basic needs or expenses. It’s a temporary state, not a permanent one.

What is a word for being broke?

A simple word for being broke is “penniless” — it means having no money at the moment.

How do I deal with being broke?

Start by tracking your expenses, cutting non-essentials, and saving small amounts regularly. Focus on earning more skills, avoiding debt, and staying positive — being broke is temporary if you take smart steps.

Is “being broke” a slang?

Yes, “being broke” is an informal slang phrase that means having no money or being out of cash.

What are the signs of being broke?

Signs of being broke include living paycheck to paycheck, borrowing often, struggling to pay bills, having no savings, and feeling constant money stress.

Read more: Top 10 Social Media Ideas for Business [Boost Wealth]

Final Thoughts

Being broke is not the end; rather, it is the beginning. You can alter your life and build genuine wealth by adopting the correct mindset, habits, and financial strategies. Start small, stay consistent, and transform your broken days into a success story.

If you find these tips useful, don’t hesitate! Begin adopting these 7 tried-and-true methods to turn your financial situation around today. Share your journey with friends and encourage them to take charge of their finances.

- 💬 Comment below.

- Which one of these seven strategies will you implement today?

- 🔗 Share this post: Help someone else get from broke to financially free!

Also visit our other platform like instagram and youtube to stay inspired. 🩵